A carding attempt occurred when fraudsters use a list of the stolen credit cards and try to verify them by performing purchase transactions. As a result, you may noticed abnormal growth in sales in a day or two, which would cause you lots of troubles and chargeback losses if this went unnoticed and not properly handled.

With FraudLabs Pro validation rules, this malicious carding attempts can be reduced by using the velocity and the blacklist validation (based on our crowd-sourced blacklisted records). Below are the steps to create the rules:

- Login to the FraudLabs Pro Merchant Control Panel.

- Click on the Rules menu.

- Click on the Add Rule button.

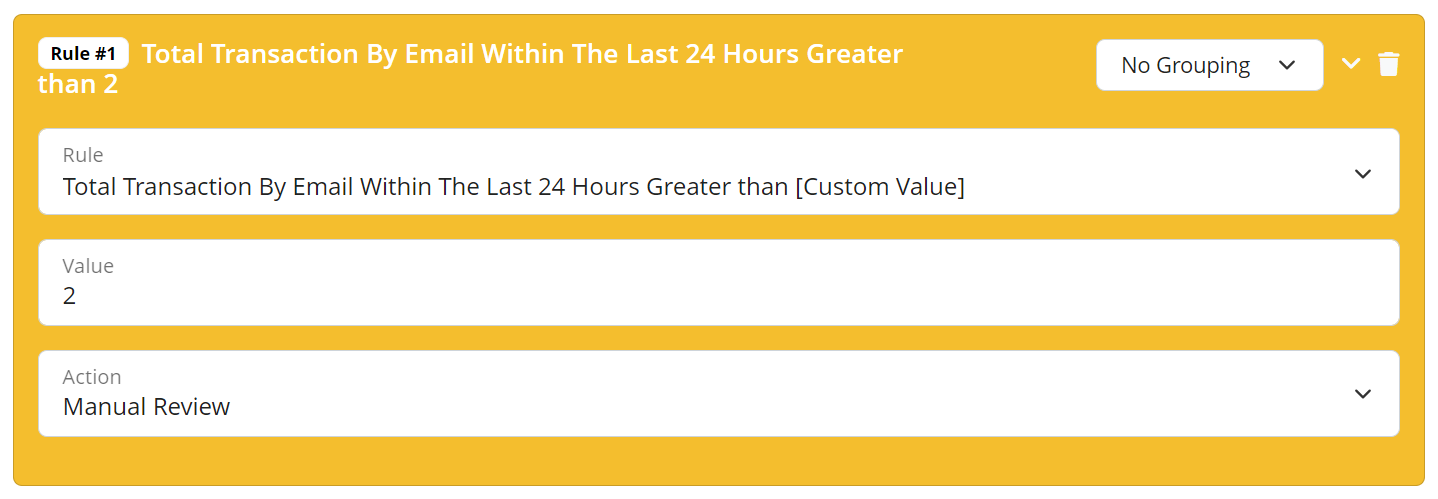

- In the Rule dropdown box, select Total Transactions By Email Within The Last 24 Hours Greater than [Custom Value].

- Then, Enter the value in the Value field. Note: You may set the value to 2, but this will also depend on the nature of your business.

- Select the Manual Review action.

- Click on the Add Rule button to add another rule.

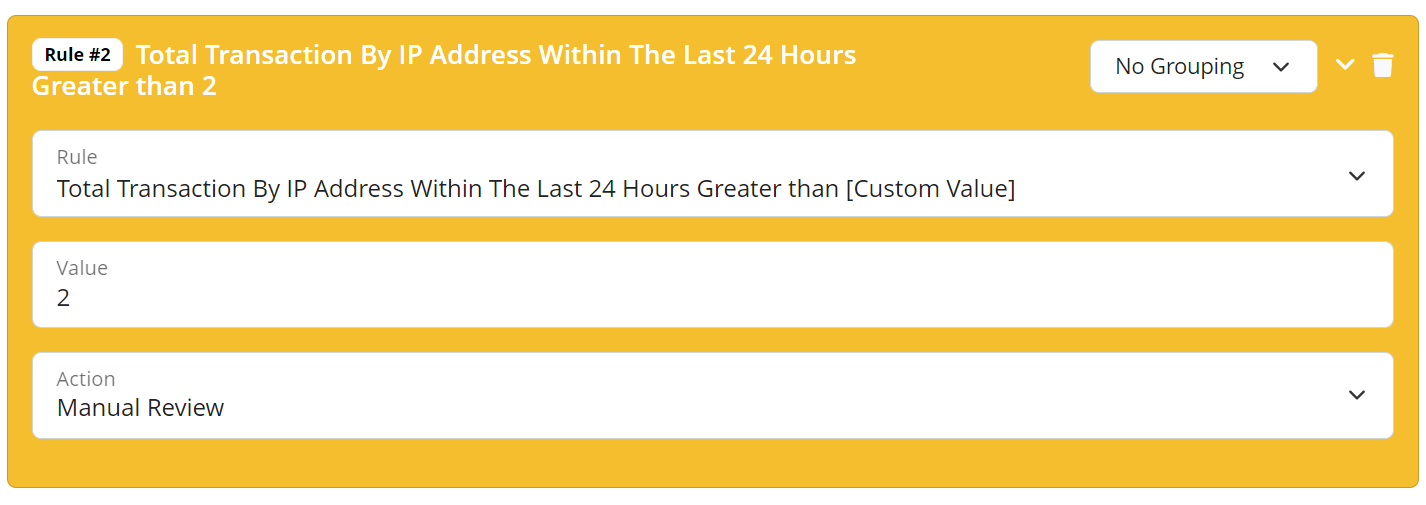

- In the Rule dropdown box, select Total Transactions By IP Address Within The Last 24 Hours Greater than [Custom Value]. (In this example, we will be performing the amount velocity check).

- Enter the threshold value in the Value field. Note: You may set the threshold to 2, but this will also depend on the nature of your business.

- Select the Manual Review action.

- Click on the Add Rule button to add another rule.

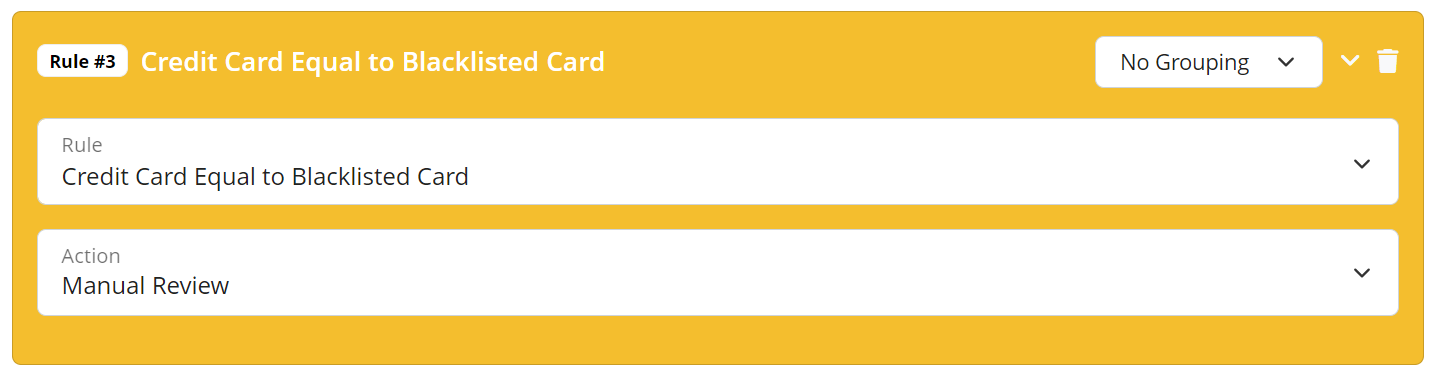

- In the Rule dropdown box, select Credit Card Equal to Blacklisted Card.

- Select the Manual Review action.

- Click on the Save button.

The above rules will help you to identify the fraudsters whose used the SAME email address or IP address to perform the carding attempt.

Ready to start with FraudLabs Pro?

Get Micro plan for free, you can quickly explore and integrate with our fraud prevention solution in minutes.