Businesses use loyalty programs as a marketing strategy to motivate customers to make repeat purchases of their products or services by offering rewards or benefits. Loyalty programs which include discounts, exclusive offers or free products or services are good in strengthening customers’ relationships with brands or services and thus boosting sales. As more and more businesses start using loyalty programs, naturally fraudsters will take note. Fraudsters will take advantage of vulnerabilities in the loyalty program’s structure. Exploiting such deficiencies allows them to obtain rewards or benefits they are not rightfully entitled to. Thewisemarketer reported that the estimated cost of loyalty fraud to program operators is estimated to be over $1 billion every year.

Loyalty fraud can lead to financial losses from stolen rewards and a loss of trust from customers. Before things worsen, it is important to take some steps to prevent loyalty fraud to protect businesses.

What is loyalty fraud

Loyalty fraud which is also known as reward fraud or point fraud happens when fraudsters exploit loyalty programs for their own gain. This type of fraud can include activities such as creating multiple accounts, using stolen or fake information to sign up, or exploiting program loopholes to earn rewards without spending money.

Types of loyalty fraud

Fraudsters often target customers’ loyalty accounts by using various methods, including account takeover, point theft, coupon fraud, and card-not-present fraud. Knowing what kind of loyalty fraud types will help to detect and prevent it.

Account takeover fraud

Fraudsters gain access to customers’ loyalty accounts by stealing their login credentials. Then, the fraudsters redeem rewards, points or benefits associated with the accounts. They usually achieve this through phishing attacks, password reuse, or exploiting weak security measures.

Point theft fraud

Fraudsters steal loyalty points from customers’ accounts. They may also manipulate loyalty systems to increase their rewards balance via bugs or loopholes in the system.

Coupon fraud

Fraudsters use fake coupons to obtain discounts or rewards. By using brute-force, fraudsters can try out various permutations of coupon codes.

Internal fraud

Members from within the organization abuse the loyalty programs. They will commonly give their friends and family freebies or discounts.

Friendly fraud

Customers violate terms of service to claim unauthorized benefits. E.g., multiple members of a family accrue points on the same account.

Why fraudsters target loyalty programs

- High value of rewards like discounts, free products or services, and exclusive offers.

- Vulnerabilities in the programs (Weak security, lack proper verification or validation protocols).

- Low-risk crime as authorities are unlikely to prosecute such cases.

- Users didn’t bother to check the accounts or points regularly.

The impact of loyalty fraud on businesses

Loyalty fraud can have a significant impact on businesses, both financially and operationally. Here are some of the key ways in which loyalty fraud can affect businesses:

- Financial Losses

- Fraudulent activities like point theft, reward abuse and so on can cause financial losses.

- Affect the revenue of the business.

- Customer Disruption

- Cause dissatisfaction and frustration.

- Customers feel that their accounts are not secure.

- Lose trust in the loyalty program and the business.

- Reputation Damage

- Loss of customer confidence and trust that leads to reputation damage.

- Legal Consequences

- It is a criminal offense.

- Result in fines, lawsuits, and reputational damage for businesses.

How to detect & prevent loyalty fraud

There are several prevention strategies that businesses can implement to protect their loyalty programs and customers from fraudulent activities.

Enforce strong passwords and multi-factor authentication

Account holders should use strong passwords and 2FA.

Monitor all account activity

Ask customers to verify themselves before using any rewards or points.

Limit point redemption and coupon usage

Make loyalty account points or coupons inaccessible for a certain length of time.

Educate customers on loyalty program policies and best practices

Educate about the dangers of loyalty fraud and the importance of monitoring accounts. E.g., the need to update their passwords regularly.

Reach out to inactive users

Might have lost interest or cannot engage with the service. It is a good idea to turn user accounts into dormant accounts after a period of inactivity.

Use a fraud prevention solution

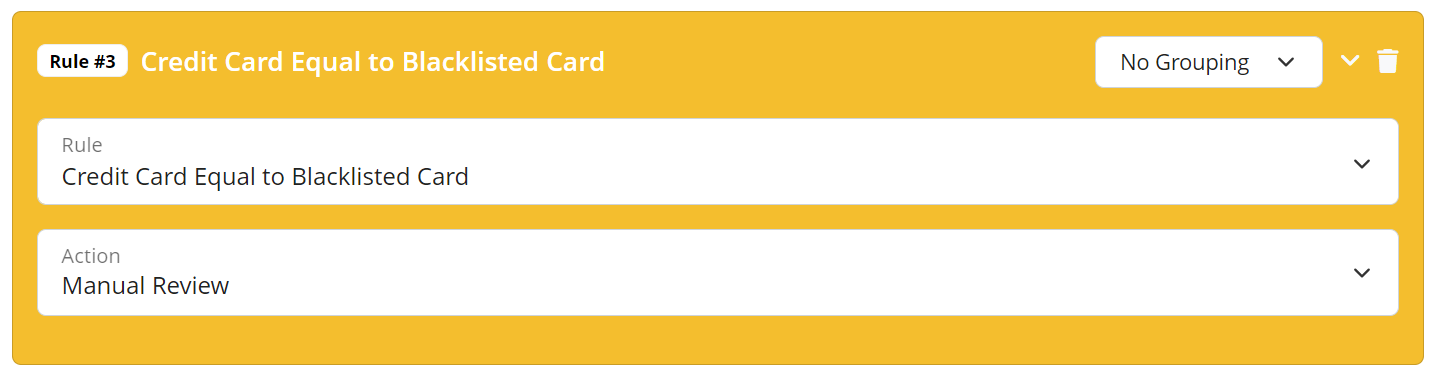

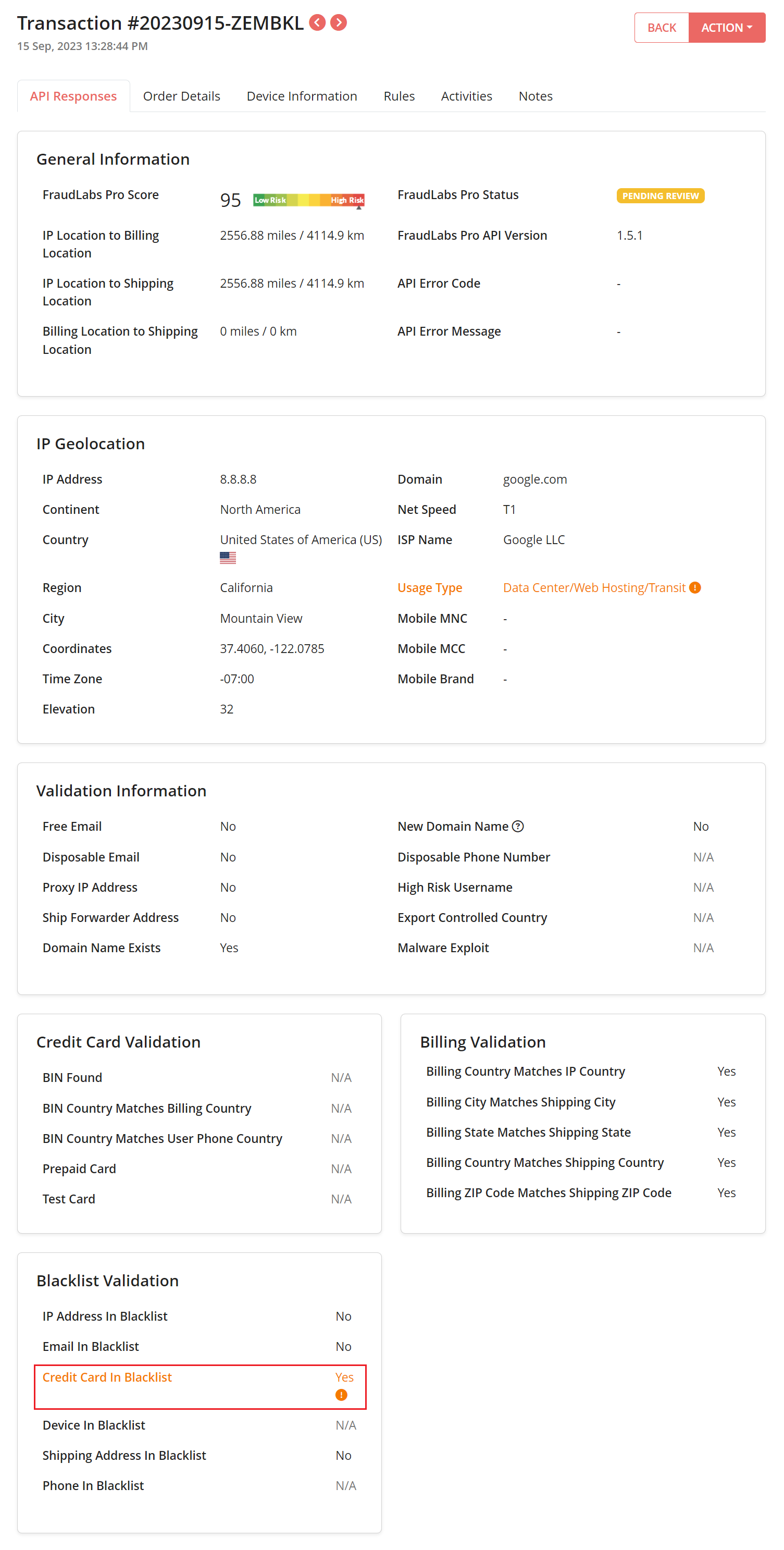

Use FraudLabsPro SMS Verification for identity verification. Identify and prevent fraudulent activities in real-time. Flag suspicious usage of an account by detecting IP addresses, credit cards and so on. E.g., create fraud validation rules to block users from specific countries, flag a shopper whose credit or debit card country doesn’t match their IP address country and so on.

Below are the screenshots of fraud validation rule and transaction details.

Conclusion

As technology and reward systems develop, the likelihood of fraud also increases. Therefore, detecting and preventing loyalty fraud is an ongoing battle. Implementation of loyalty fraud strategies like using a fraud prevention tool can surely help merchants in combating loyalty fraud.