What is a chargeback

Chargeback is the process of reversing a credit card transaction by the cardholder’s bank. It will happen after the cardholder disputes a transaction. Understanding chargebacks is crucial for businesses to effectively manage disputes and maintain healthy merchant-consumer relationships. Initially, the chargeback was introduced to protect the consumer from incorrect billing or unauthorized transactions on their credit card. However, in recent years, the chargebacks are being abused by some people for their own interest.

Growing problem for merchants

Merchants, payment networks and banks are concerned about the chargeback as the chargeback requests are increasing year by year, and merchants are suffering loss due to the chargeback itself and the cost of processing the chargeback.

A study carried out in the US suggests that the cardholders in the US disputed a minimum of $65.2 billion worth of charges in 2023, and 78% of the US cardholders admitted that they had requested the chargeback at least once in 2023.

This shows that the chargeback issue had becomes one of the most concerning issues in industry. Fostering a culture of understanding chargebacks helps businesses proactively address issues, minimize losses, and improve overall customer satisfaction.

Understanding Chargebacks vs. refunds

Although the outcome of chargeback and refund are returning the money to the customer, they still differ in some ways.

Those differences are:

- Involvement of parties: Refund only involves merchant and customer usually, while chargeback will involve at least three parties which are the merchant, the customer and the bank or card issuer.

- Initiation: Refund usually initiated by the merchant after requested by the customer or the merchant found some issues regarding the goods sold to the customer. The chargeback, on the other hand, is initiated by the customer through the bank.

- Voluntary or not: Refund is a voluntary action taken by the merchant; however, chargeback can be forced onto the merchant by the bank.

How do chargebacks work

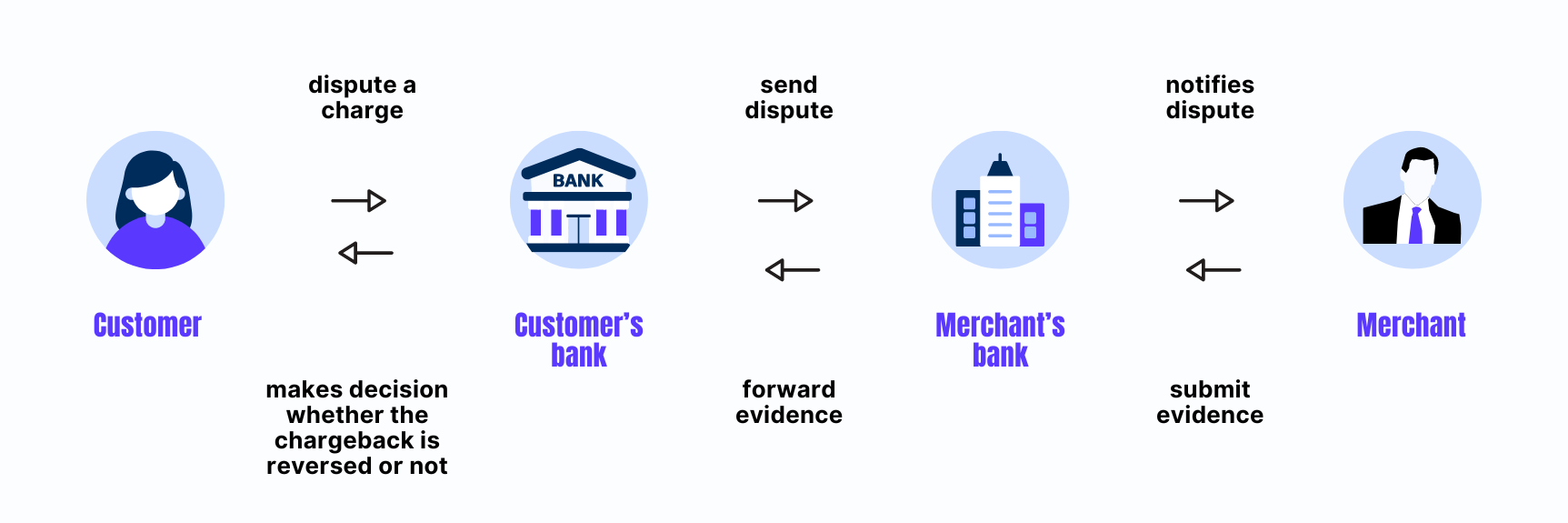

Usually, chargebacks take some steps to complete before the customer gets the money back or the merchant manages to reverse the chargeback.

Here is the basic process explained:

- The customer will raise a chargeback dispute to the card issuer (customer’s bank) or financial institution.

- The card issuer or financial institution will launch their investigation after receiving the chargeback request.

- If they find that the request is valid, they will then issue the chargeback to the merchant, and notify the merchant about the chargeback and the details of the related dispute transaction.

- If the merchant believes that the chargeback is invalid, they can challenge the chargeback by responding to the bank within a time frame and providing evidence to challenge the chargeback.

- The financial institution will review the evidence sent by the merchant.

- Then, they will make a final decision on whether to accept the defense made by the merchant, or accept the dispute made by the customer.

Reasons for chargebacks

There are many reasons why a chargeback happens.

Below are the common reasons:

Fraud

Cardholder found that some unauthorized transaction is happening by other’s hand rather than their hand, hence disputing the transaction. The unauthorized transaction can happen due to the card being stolen, or the card’s information has been leaked.

Unsatisfied with the quality of product and service

If the customer got upset with the product or service they received, sometimes they might just issue a chargeback instead of trying to communicate with the merchant. If the customer didn’t receive the product that was supposed to ship to them, they may also be eligible for the chargeback.

In addition, more and more merchants are providing subscription services to their digital products as a trend. While this is useful to boost the revenue, it may also lead to an increase in chargeback request. Some of the reasons are either the merchant continues to charge their customer although the customer has already cancelled the subscription, or the customer gets charged after the free trial ended but they didn’t know about that.

Friendly fraud

Usually happens when the customer itself makes an illegitimate chargeback request either intentionally or unintentionally. There are many reasons why friendly fraud happens, for example the customer wants to get the product for free (also known as cyber shoplifting), the family member of the cardholder used the card without permission from the cardholder itself, or the customer thinks that chargeback is faster than the refund.

The costs and consequences of chargebacks

Generally, if a chargeback is successfully executed, the merchant will suffer losses in some aspects.

These include:

- Revenue: When a chargeback is approved by the cardholder’s bank, the merchant will be required to refund the money to the customer. This will lead to a deduction to the revenue at the end.

- Additional cost: When the bank is processing the chargeback request, they will also charge a processing fee to the merchant. Depending on the banks in different countries, sometimes the fee is not reclaimable even if the chargeback is disputed.

- Loss of goods or services: Sometimes, if the customer purposely makes a chargeback although he or she had received the goods, the merchant might not be able to get back the good sent.

Aside from those short-term consequences, the merchant will also suffer from the long-term consequences. This is because merchants had a predetermined threshold for the chargeback rate set by their payment provider that they must follow. If the payment provider found that the chargeback rate exceeded the threshold set, the payment provider may penalize the merchant with a fine.

If the condition continues, the payment provider may have the right to terminate their contract with the merchant. In the worst-case scenario, the merchant will be blacklisted and marked as a high-risk business. The merchant will need to find another payment provider that is willing to accept high-risk business or company.

How to dispute chargebacks

When the customer raised the chargeback dispute, the merchant will receive a notification regarding the chargeback dispute.

If the merchant would like to dispute the chargeback, below are the steps that required:

Collect information

The merchant will need to identify the customer and the transaction details, such as the delivery status of the goods, and the payment details. This information can be used as evidence for disputing chargeback.

Merchants can also try communicating with the customer to see if the issue can be resolved amicably.

Submit chargeback response

After gathering information needed, merchants can now submit their dispute response to the bank. The merchant can return the chargeback letter issued by the bank if available, or initiate their own chargeback dispute. Remember to attach the evidence collected along with the response.

Wait for decision and further follow up

After submission of the dispute response, the merchant must remember to monitor the progress, and make the follow up if necessary. If the bank requested any additional information, the merchant had to ensure that they replied on time.

To find how to dispute chargeback for different payment gateways, kindly visit this article.

How to prevent chargebacks

Chargeback can cause not only loss to the merchant’s current profit, but also bring long-term consequences to the merchant.

In order to minimize the chance of a chargeback, here is what merchant can do on their side:

Make the return process simple, easy and fast

Merchants must ensure that they respond to the return request as soon as possible. They must also ensure customer satisfaction throughout the return process. There are some merchants setting a lot of conditions for the return or refund process just to avoid any refund request from the customers. However, if the request is valid and the merchant makes the return process a hassle, then the customer may have no choice but to initiate a chargeback request.

Sometimes, the customer might feel that the return policy is too hard to understand for them. Hence, it is advisable that the merchant state the terms and conditions for the return process in a short but clear manner. The merchant is also advised to communicate with the customer promptly if they inquire about the return process.

Ensure the good delivery process is fast and efficient

It is the merchant’s responsibility to choose a reliable delivery service to deliver the goods. However, some merchants will tend to find a cheap delivery service without checking the reliability of the service just to save their cost. As a result, the goods might not be able to reach the customer’s hand.

Also, some of the workers of the delivery service will damage the goods intentionally or unintentionally. The customer will be dissatisfied with the damaged goods and will dispute the purchase in the end.

Use fraud detection software to detect illegitimate chargebacks

As e-commerce is becoming more common in today, merchants should leverage the use of fraud detection software or service to minimize the occurrence of fraud or chargeback in the online transaction.

A good fraud detection software should be able to detect any potential fraud before the transaction continues. This will help in reducing the chances of fraud and the need for chargeback because of the fraud.

For example, by using Fraudlabs Pro, merchants will be able to review manually any transaction that is high-risk. Merchants are also able to make use of the blacklist feature, which lets them block the customers that they know are likely to commit the chargeback fraud.

Conclusion

Chargeback is a potentially business crippling factor. Once your business gets saddled with one too many chargebacks, your bottomline will suffer and you end up losing your business. Businesses must invest time in understanding chargebacks to identify root causes and implement preventive measures. By equipping yourself with the knowledge above, you can hopefully prevent chargebacks or successfully resolve them to your advantage.

Free Fraud Protection Today!

Start safeguarding your business with FraudLabs Pro Fraud Prevention at Zero Cost!