Fraudulent activities can have a significant impact on businesses and individuals, leading to financial losses, reputational damage, and a loss of trust. To effectively combat fraud, it is crucial to incorporate distance measures into your fraud prevention strategy. By leveraging the concept of distance, you can enhance your ability to detect and prevent fraudulent activities. Let’s delve deeper into some key techniques that utilize distance to prevent fraud in FraudLabs Pro.

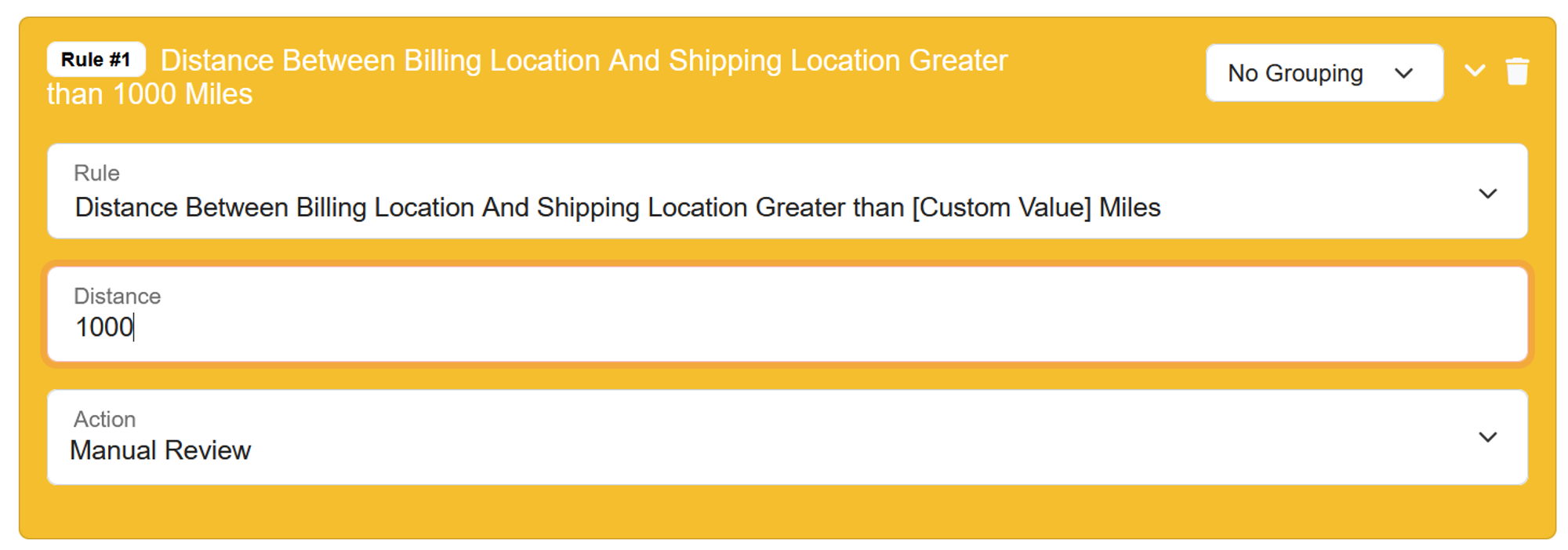

Billing Address vs Shipping Address

Verifying the consistency between the billing address and the shipping address is a fundamental step in preventing fraud. When processing transactions, it is essential to ensure that the billing address provided by the customer matches the shipping address. Any discrepancies or suspicious changes should raise concerns and prompt additional verification steps to confirm the legitimacy of the transaction. Especially when there is a significant distance difference between the billing and shipping addresses. Implementing automated systems that flag any inconsistencies and require further authentication from the customer can significantly bolster your fraud prevention efforts. Below is the example of the fraud validation rule to flag the transaction for review if the distance between the billing and shipping address is greater than 1000 miles.

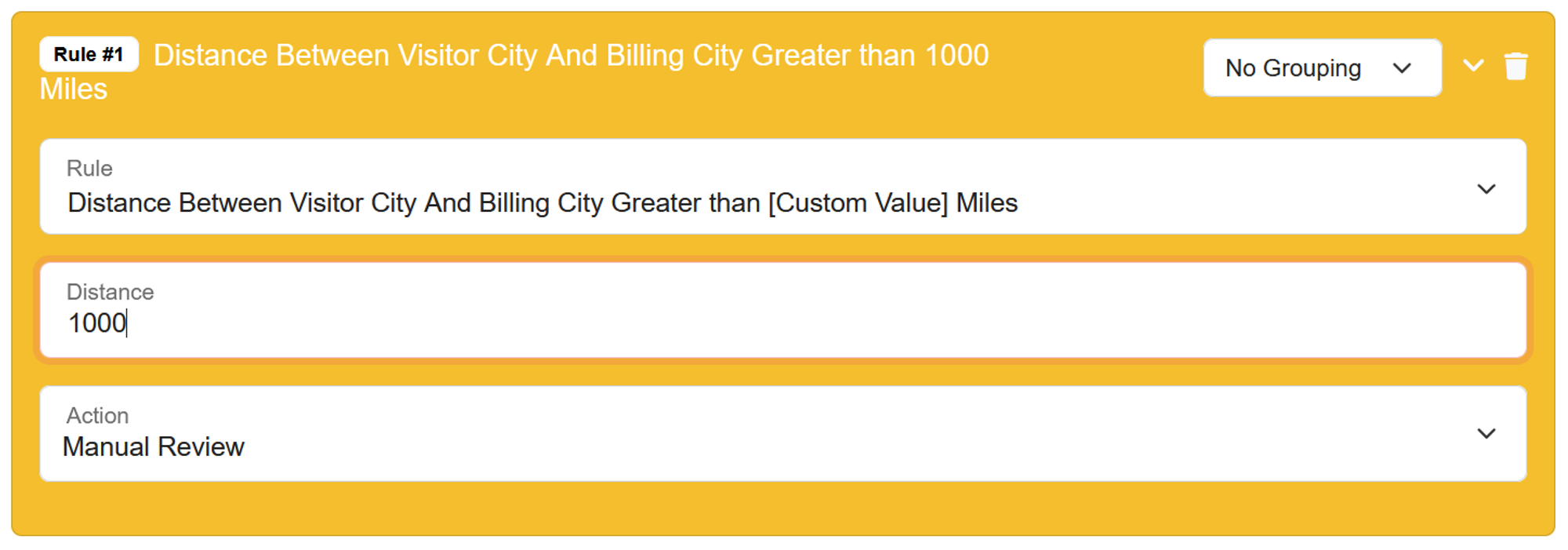

IP Location vs Billing Address

Comparing the location of the IP address used during a transaction with the customer’s billing address is another valuable technique. The IP address provides information about the geographical location from which the transaction is initiated. If the IP address indicates a location that is significantly different from the billing address, it may raise a red flag for potential fraud.

In such cases, it is crucial to implement additional authentication measures to ensure the transaction’s legitimacy. This could involve sending a verification code to the customer’s registered phone number requiring them to confirm their identity before proceeding with the transaction – an SMS Verification technique. Additionally, you may consider using geolocation services to validate the IP location and detect any suspicious activity, such as if this is an anonymous proxy. Below is the example of the fraud validation rules to check the distance between city location of an IP address and billing address for fraud review.

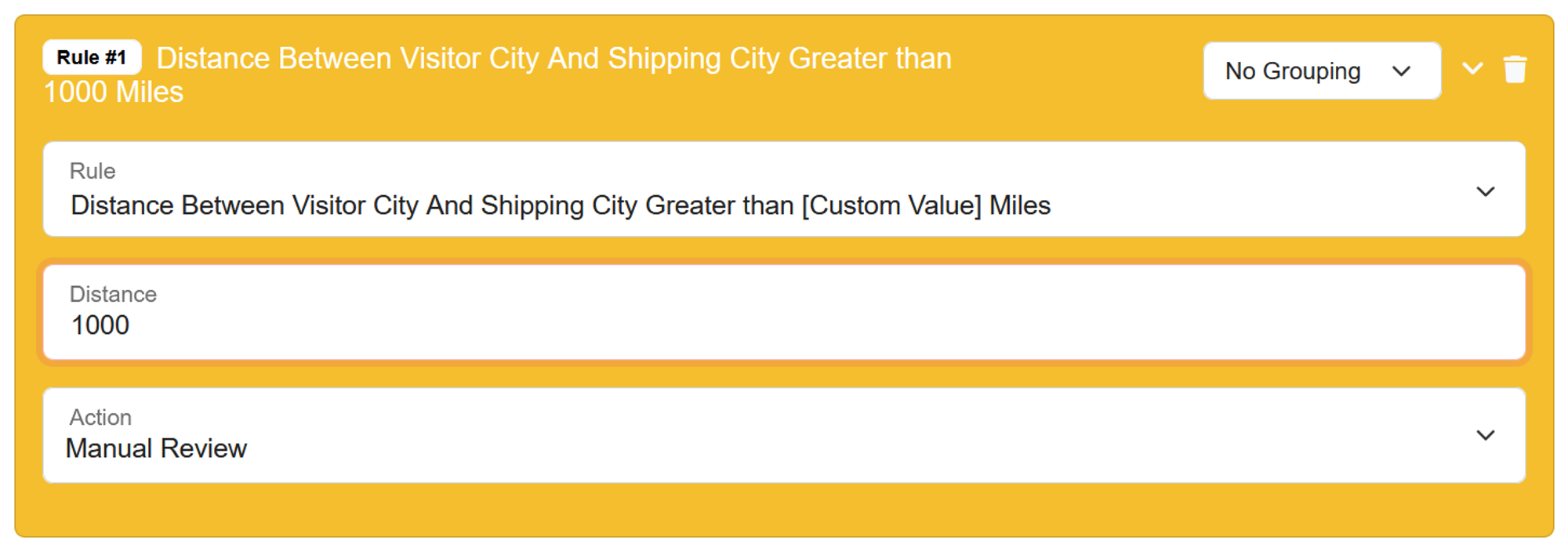

IP Location vs Shipping Address

In addition to comparing the IP address location against the billing address, considering the IP address location in relation to the shipping address provided by the customer can provide valuable insights. If the IP address is geographically distant from the shipping address, it could indicate a potentially fraudulent transaction. For example, if the customer’s shipping address is in New York, but the IP address shows the transaction is initiated from a different country, it raises suspicion.

In such cases, it is advisable to conduct further verification or directly contact the customer to confirm the order’s authenticity. This proactive approach is especially useful for businesses that involve shipping goods and can help prevent fraudulent activities. Additionally, you may also consider validating if the given address is a shipping forwarding address, as this could be another red flag for potential fraud. Below is the example of checking the IP location (city location) versus the shipping address for fraud detection.

The Disparity of Distance for Effective Fraud Prevention: How Far?

While incorporating these distance-based measures is essential for fraud prevention, it is equally important to strike a balance between preventing fraud and maintaining a smooth customer experience. Implementing excessive security measures can inconvenience legitimate customers and potentially lead to a decrease in sales and customer satisfaction. Therefore, it is crucial to employ these techniques judiciously, considering the unique characteristics of your business and continuously monitoring and updating your fraud prevention systems to adapt to evolving fraud tactics.

Remember, fraud prevention is an ongoing process that requires constant vigilance and proactive measures. There is no one-size-fits-all approach for businesses, even within the same industry. Factors such as customer base, marketing strategy, fraud tolerances, and other considerations should be carefully evaluated. It is also important to regularly review and analyze the data collected through these measures to identify any patterns or trends from other fraud data points (elements) that may indicate potential fraud. This will help you to come up with an optimized distance value for fraud detection.

In conclusion, by implementing distance-based fraud prevention measures, businesses can significantly reduce the risk of fraudulent activities, but remember to strike a balance between security and customer experience.